How can I apply for a Regular Saver?

1st Account customers can apply by downloading and logging on to our App and going to ‘Products’ or via Online Banking.

How do I make payments into my regular saver?

Your first payment will be taken from your 1st Account on the day we open your Regular Saver Account. This will be followed by another 11 monthly payments which can only be made by standing order from your 1st Account (we will set this up for you).

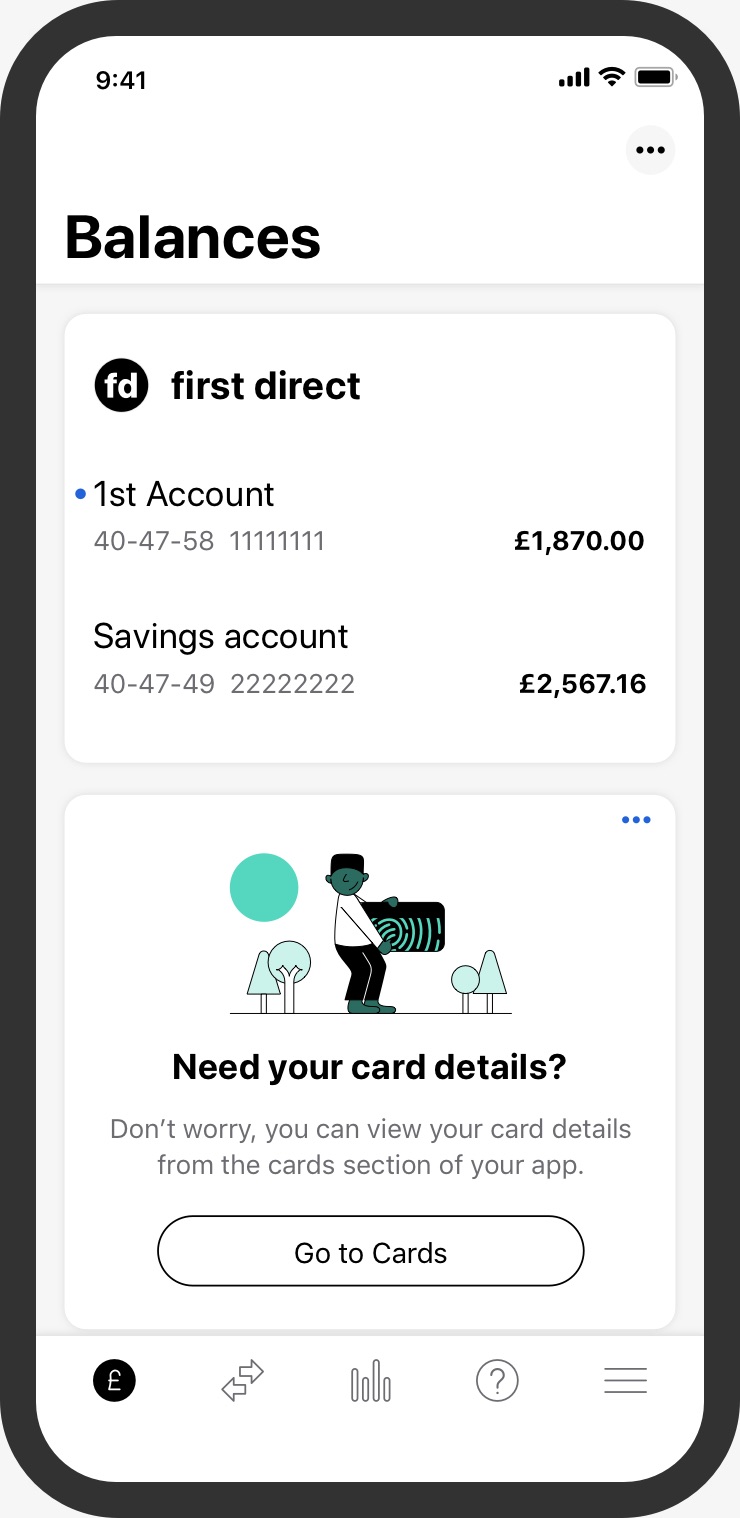

How do I manage my account?

You can view your account in our App and Online Banking. To amend your standing order payment please chat with us via our App, Message Us via Online Banking or give us a call and we’ll be happy to help.

You can change the amount of the monthly standing order between £25 and £300 (in multiples of £5) but you can only make one standing order payment to your account in any one month. The date of your standing order payment needs to remain the same once set up.

Are there any charges?

No , none at all.

Can I make withdrawals?

Our Regular Saver Account is for 12 months so, as you'd expect, you can only withdraw your money after a year. You can access your money before then, but you'll have to close the account. If you choose to do this. we'll pay interest up to that day and you'll receive interest equivalent to our Savings Account variable rate

Can I apply for a new Regular Saver Account if I have one open already?

No, you can only have one Regular Saver at any one time even if you’re not saving the maximum allowance of £300 per month.

I have a joint account, can my joint party open a Regular Saver?

Yes, providing they don't already have one.

Is there anything else I need to know?

For at least the duration of the Regular Saver, you must hold a first direct 1st Account from which to make your monthly payments.